Alternative ways to Invest in Gold and Silver

Over the last few weeks and months, Gold and Silver have fallen heavily.. over 20%.

Considering that since 2009, Gold has gone from around $700 to $1800 in mid 2012, a correction of some sort was expected. In 2012, Gold actually didn’t do too much.. it oscillated between $1600 and $1800 and earlier this year, it finally broke down below the $1600 support level and hit a bottom at around $1200.

Over the past couple of weeks however, we may have seen the end of Gold’s decline. In fact, there are some people who are saying that Gold is a long term buy and this may be the time to get in cheap!

Mostly, I speculate on Gold buying and selling on the Spot price. However, there are alternative ways to invest in Gold (and Silver) which I thought would be interesting to mention. When I mention invest, I mean that you’re looking for a buy and hold strategy.. you’re looking to buy and keep Gold or Silver for a while.

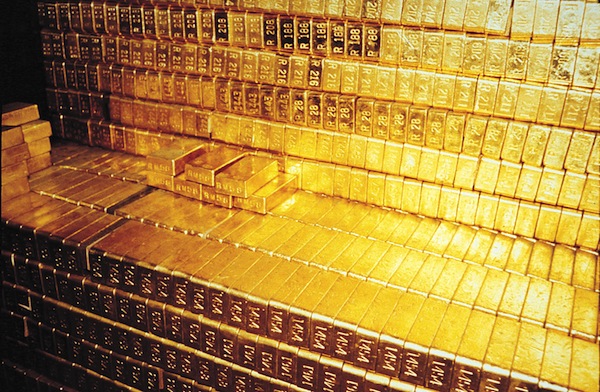

The first alternative way to invest that I’ve found is a company called Bullion Vault. Bullion Vault allows you to buy and sell Gold and Silver bars! Ok, you can buy per ounce also if the price of a bullion bar is too expensive (currently $41,000 or so for 1 gold bar!). As they service 45,000 people they are able to offer pretty good rates.

Another alternative is to buy into Gold ETF (Exchange Traded Funds). These are low cost trackers which follow the Gold price. There are quite a few Gold ETFs so you need to make sure it’s one from a reputable company. One’s which I’ve heard about are the iShares COMEX Gold Trust from Blackrock and the SPDR Gold Trust profile from State Street.

The other alternative is to buy into Gold mining companies. However, you need to find one that does correlate with the Gold price or if you’re lucky, you may find one which is undervalued compared to it’s assets.